题目:What are the most important economic effects - good and bad - of forced redistribution? How should this inform government policy?

从一开始,冠状病毒危机的元叙事就是加剧了现有的不平等:所有人都身处同一场风暴,但绝不是同一艘船。美国劳工统计局估计,在2020年4月,收入分配中处于最低20%的员工失业的可能性是收入最高20%的员工的四倍,而收入最高20%的员工的平均储蓄倾向实际上是由于放弃支出而上升的与此同时,熊彼特式的创造性破坏力量在市场不确定性下加剧,成为当前技术垄断和平台资本主义趋势的代表,预计到2026年,杰夫·贝佐斯将成为世界上第一个万亿富翁然而,这些最近的趋势将自己置于更广泛的潮流之中:自从皮凯蒂提出著名的假设以来,马克思将资本集中列为“资本主义生产的内在规律”之一的说法获得了新的权威因此,判断政府干预对防止这种惰性是必要的,本文将寻求建立日益平等的首要原则:强制再分配最重要的经济效应。在考虑结果主义分析在告知政府政策方面的局限性之前,它将通过收入、继承和托宾税的透镜来权衡这一点与潜在的效率下降。

最根本的是,英美现状构成了一种社会低效的资源分配。假设财富边际效用递减,可以构造一个柏克森-萨缪尔森- swf,由此推导出凸的社会无差异曲线;当与社会效用分配边界相比较时,这些决定了一个仅显示中度不平等的最大值伊斯特林悖论证实了这一结论,认为幸福和财富之间的相关性超过临界值时可以忽略不计。与此同时,联合国(United Nations)的一项分析显示,1989年至2006年间,美国收入增长的91%来自收入最高的那十分之一人群,这使得不平等通过“涓滴效应”绝对惠及所有人的传统假设,令人遗憾地失去了说服力。

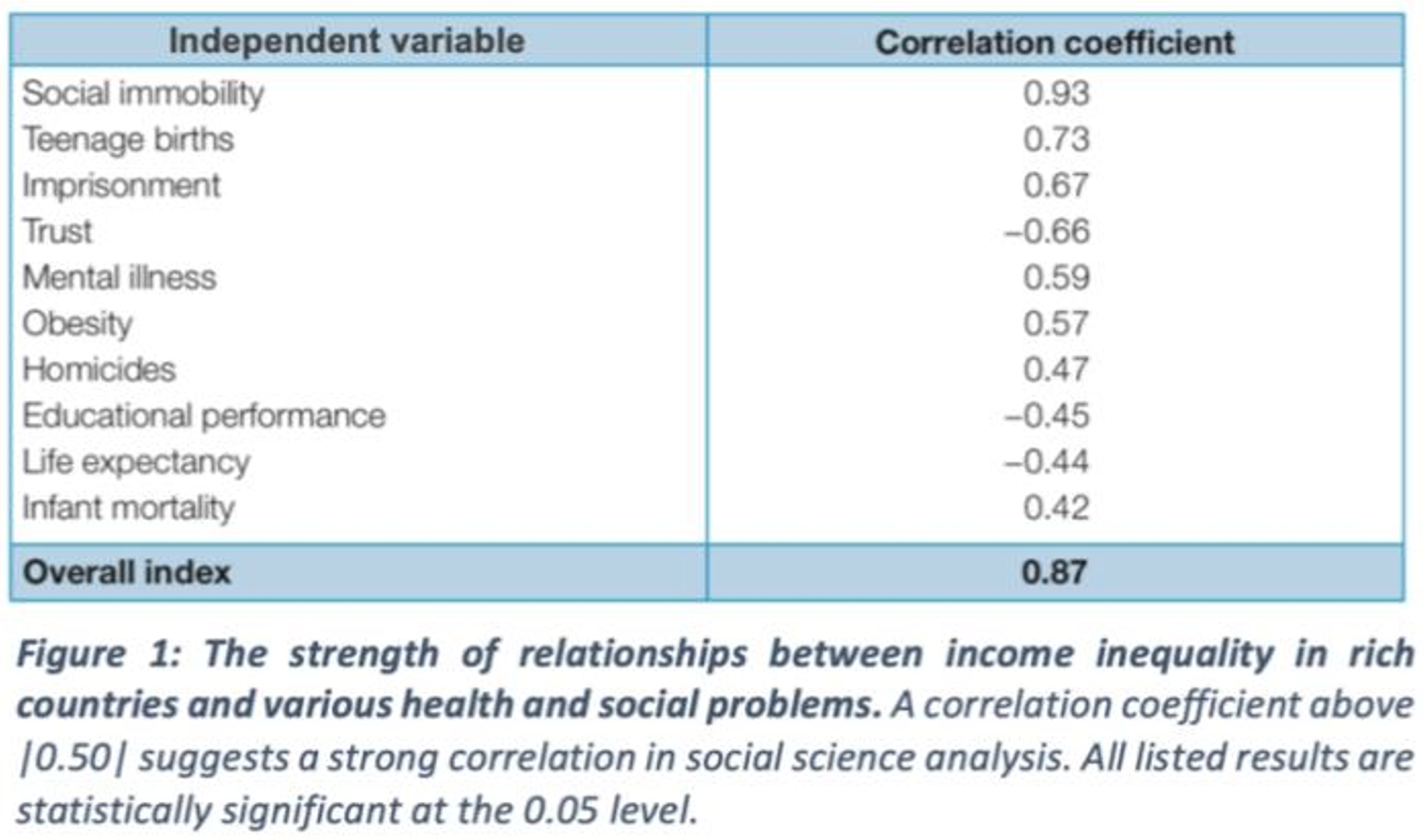

此外,威尔金森和皮克特认为,不平等会产生严重的心理成本(见图1)在他们2018年出版的《内心世界》(The Inner Level)一书中,“地位焦虑”——即害怕被物质社会视为不成功的人——被假定为这一现象的一种基于进化的因果机制:与其他灵长类动物一样,人类的皮质醇水平会随着社会统治等级的不稳定性而升高考虑到福柯定义的新自由主义固有的不稳定性(“竞争延伸到生活的方方面面”),[10]以及最近个人收入在转会前和转会后的差异随着时间的推移而爆发,威尔金森和皮克特的主张获得了更大的信任。

关于不平等的文献经常在机会平等和结果平等之间进行划分;斯蒂格利茨虽然小心翼翼地不否认某些收入差异是静态和动态效率的需要,但是,他认为这种区别是错误的二分法自苏格兰启蒙运动(Scottish Enlightenment)以来,经济学家已经认识到,不平等具有激励投资、创新和冒险的功能;然而,低收入家庭的儿童往往得不到教育、保健和经济机会,无法对这些激励措施作出反应。抛开公平不谈,这些障碍意味着人力资本不发达的总机会成本,使工人的职能灵活性和职业流动性较低。德勤(Deloitte)估计,在蓬勃发展的数字时代,一项学习技能的半衰期只有4.5年——而上一代人的半衰期是26年——鉴于此,这种不行动肯定令人不安

此外,与卡尔多所说的在效率与平等之间进行权衡的观点相反,高基尼系数会破坏增长的观点现在正成为学术上的正统观点对此的一种解释借鉴了凯恩斯的消费理论:由于低收入者有更高的边际消费倾向,他们的可自由支配收入较低,导致高的未完全需求。另一个理由表明,贸易保护主义的流行呼声可以归因于金融脆弱性:英美工人比欧洲大陆工人更抵制提高效率的重组,部分原因是他们失去工作的风险要大得多。一个健全的社会安全网也可能作为一种担保,将企业家的风险厌恶情绪降至最低;这与英国破产法93节和美国破产法第二章的逻辑是相似的然而,即使有人拒绝上述所有的分析,事实上,自由主义残留的美国在1990-2008年的年增长率为1.8%,而社会民主的挪威为2.6%,这表明平等至少不会对效率不利

最后,人们越来越怀疑,威尔金森和皮克特所描述的社会心理不稳定在金融领域也存在。拉詹提出了不平等与信贷危机之间的关系,他指出,“在历史上,宽松的信贷一直被政府用作一种缓和手段”,以维持总需求,并在收入停滞的情况下缓解消费不平等据推测,这种效应导致了2008年明斯基时刻的过度杠杆化,这是灾难性的。显然,由于危机代价高昂,作为债务预防手段的再分配,比决议等事后工具更可取。

因此,我们可以合理地得出这样的结论:在其他条件不变的情况下,更平等的收入分配是一个理想的目标。然而,毫无疑问,cp假设过于简单化了——具体情况如何取决于所部署的政策工具。考虑三个例子:

一个标准的担忧是,累进所得税会产生效率成本,从而抵消任何分配收益首先,税收抑制了劳动积极性,因为这意味着较低的净工资,因此休闲的机会成本较低。“顶尖人才外流”和更高的流动率可能会随之而来,根据效率工资理论,代理人会减少分配给他们工作的努力。逃税/避税是一个进一步的因素,还有薪酬谈判,即假定高收入者有能力通过谈判提高工资,当税率较低时,这种激励作用最大。因此,有人认为,最高税率的削减会刺激寻租行为,尽管不一定会刺激经济增长。

在确定一个比率时,这些影响超过这个比率就等于净损失,应税收入的弹性是一个有用的参数。最终,尽管对其规模没有达成共识(Gruber和Saez计算出当前的数值为0.4,但估计范围在0到1之间),但确切的数字肯定将取决于消除法律漏洞和贫困陷阱。后者在英国是一个常见的问题,2017年环球信贷(Universal Credit)的提案让家庭的平均年收入减少了1144英镑,而第二份收入的人每周要多做5个小时的最低工资工作政府必须小心避免制造这样的“陷阱”。

同时,最优转移规模应根据道尔顿最大社会优势原则确定,支出的边际社会效益等于边际社会成本这种计算应该包括通胀、财政可持续性和机会成本:特别是,通过解决不平等的驱动因素,资本支出是否可能成为一个更有效的长期衡量指标对于转移会鼓励搭便车和“依赖文化”的担忧应该予以考虑,但不应过分强调:由于一再经受不住实证审查,他们的陈述往往类似于韦伯分层的道德修辞

然而,所得税忽略了这样一个事实:收入基尼系数平均只有财富基尼系数的一半;遗产税似乎是纠正这种不平衡的一种直观方法然而,令人惊讶的是,沃尔夫质疑这种直觉是否被误导了,他假设遗赠实际上减少了财富的不平等,因为与富裕家庭相比,转移在贫困家庭当前持有的资产中所占比例通常更大但最终,长期的动态会破坏这一建议:较贫穷的代理人通常会花掉他们的收益,而富人则有能力把它们存起来。也有人认为,遗产税增加了资本稀缺,从而产生了资本回报,从而在总体上加剧了不平等实证分析为这一主张提供了一些基础,尽管它仍然不太可能在规模上足以使再分配总体上产生反效果

与所得税一样,对弹性的考虑也适用于继承,还有一种可能性是,高利率可能会刺激肆意消耗储蓄。尽管如此,当考虑到伦理上的观点,即继承的财富目前是任意分配的(根据“出生抽签”),征收更高税的理由似乎很充分:今天,只有5%的英国遗产需要缴纳遗产税

最后,托宾税是一种针对金融交易的小额从价税,其负担主要落在最富裕的资本所有者身上虽然征税将普遍增加交易成本,但货币投机实际上是唯一一种发生频率足够高的交易,其收费如此之低,足以纳入交易员的成本效益分析;因此,欧洲议会(European Parliament)估计,0.1%的增长率将增加500亿美元的年收入,同时对实体经济几乎不会产生扭曲效应

但是,如果单方面实行严格的控制,可能会使一个国家失去竞争力;这对英国尤其不利,因为英国金融服务占经济总产出的6.9%对于“免费搭上选择性退出管辖权”这一集体行动问题,一个解决办法可能是,要求将实施税收作为进入IMF等超国家组织的条件;然而,政府是否在政治上准备如此戏剧性地放弃财政主权,则是另一回事

此外,托宾税的批评者称,它可能会降低市场流动性,导致投资下降和资本成本上升。他们认为,金融交易通常是为了对冲风险而进行的,如果阻止这种做法,政策可能会破坏稳定。然而,这些负面影响最终会被减缓的资本流动减少汇率波动这一事实所抵消,从而使国家网络不那么容易受到外生冲击。众所周知,由非理性繁荣导致的对汇率的投机压力,会导致利率高于国内货币状况所保证的水平,损害增长和就业;20世纪90年代亚洲、拉丁美洲和俄罗斯的危机,在很大程度上都被归因于破坏稳定的资本流动因此,如果多边实施,托宾税可能是一种收集资金并在国内和国际上重新分配的有效方式。

尽管如此,政治经济学对结果主义分析对政策处方的影响提出了一个重大的限制。运用唐斯的中间选民理论,梅尔泽-理查德模型表明,假设收入分配向右倾斜,人口完全合理,政治-经济均衡应该建立在支持再分配政策的基础上Larcinese指出,这样的抽象概念很少得到实证观察的支持,然而,因为选民投票率与收入呈正相关,这意味着关键选民实际上比收入分配中的中位数更富有此外,关于完全理性的“经济人”(homo economicus)的假设显然过于简单:例如,有研究显示,选民低估了自己社会中不平等的程度,即便如此,他们也会更喜欢一个更平等的社会,而不是他们认为自己生活在其中的社会,这暴露了广泛的信息不对称选民在评估政策时也会考虑除私人金钱利益之外的其他因素,正如对诺齐克和罗尔斯等人物持久的公众兴趣所表明的那样。

我们还应注意到,鉴于上述冲击和长期趋势,目前公众对资金转移的高度依赖很可能会持续到中期。除了全球封锁带来的彻底重组之外,一波期待已久的自动化浪潮预计将使很大一部分中产阶级因技术失业而失业;莫拉维克的悖论指出,与要求灵活机动的任务相比,高级推理所需的计算能力更少,这意味着像会计这样的“高技能”工作特别容易受到影响因此,人们可以预期对再分配的自利公众支持会增加。

因此,归根结底,各国政府必须小心谨慎,避免引发设计不当的政策可能造成的不良影响;其中最主要的是贫困陷阱、国际竞争力下降和利用漏洞。此外,不应将再分配视为解决社会经济弊病的万灵药:例如,再分配在很大程度上未触及具体的文化资本,而要解决这一问题,就需要更广泛的供给侧干预方案然而,大量证据表明,比起维持现状,公民一般更喜欢更大程度的再分配,这些偏好在选举数据中没有得到充分体现,而且至少在可预见的未来,越来越多的人将依赖于国家的援助。再考虑到适度平等带来的更大增长、总效用和金融稳定带来的好处,我们可以提出一个强有力的理由,即再分配确实是平衡马克思学说中不断增加的苦难的必要工具

作者注解

虽然国际再分配(援助和赔偿,例如)的问题无疑值得讨论,但为了简短起见,本文重点讨论单一管辖范围内的再分配。出于同样的原因,它讨论的是公民之间的再分配,而不是企业之间的再分配;例如,补贴和公司税的作用就不在其职权范围之内。我假设这是一个相对高收入的国家,并从英国和美国获得了大部分实证数据。

Footnotes

1 Larry Elliott, ‘Unemployment due to Covid-19 is surely worth more than a footnote’, The Guardian, 10 May 2020.

2 Nick Srnicek, Platform Capitalism (Cambridge: Polity Press, 2016).

3 Leaders, ‘Big tech is thriving in the midst of the recession’, The Economist, 2 May 2020. Tech monopolies Microsoft, Apple, Alphabet, Amazon and Facebook now comprise more than one-fifth of the entire value of the S&P 500 stock market index. 4 Thomas Piketty, Capital in the Twenty-First Century (Cambridge: Harvard University Press, 2014). Here, r denotes the rate of return on capital (i.e. profits, dividends, rents, incomes and interest), whilst g denotes the overall rate of economic growth. 5 Karl Marx, Capital: a Critique of Political Economy v.1 (London: Penguin Classics, 1990).

6 Nicola Acocella, The Foundations of Economic Policy (Cambridge: Cambridge University Press, 2000).

7 Jan Vandermoortele, ‘Inequality and Gresham’s Law: the bad drives out the good’, Unpublished thinkpiece for the UN in China, March 2013.

8 Table: Karen Rowlingson, Does Income Inequality Cause Health and Social Problems? (York: Joseph Rowntree Foundation, 2011).

9 Richard Wilkinson and Kate Pickett, The Inner Level (London: Penguin Books, 2018).

10 Michel Foucault, The Birth of Biopolitics: Lectures at the College de France, 1978-1979 (London: Palgrave Macmillan, 2008).

11 Jacob Hacker, The Great Risk Shift (Oxford: Oxford University Press, 2008). Hacker notes that locus of control scores- a powerful predictor for anxiety- have become substantially more external in recent years. He credits this to the lack of a robust social safety net.

12 Joseph Stiglitz, The Price of Inequality (London: Penguin, 2013). In his book, he formalises the negative correlation between income inequality and the intergenerational mobility of wealth as ‘The Great Gatsby Curve’, which manifests tangibly as the fact that an American child whose parents fall within in the bottom decile of the income distribution has a 20% chance of reaching college, whilst for those from the top decile that figure is closer to 90%.

13 Indranil Roy, Future of Work: an Introduction, January 2019

14 Nicholas Kaldor, ‘Alternative Theories of Distribution’, The Review of Economic Studies, 23, no. 2 (1956), pp. 83-100.

15 Rema Hana, Dispelling the Myth of Welfare Dependency, 9 August 2019

16 Ha-Joon Chang, 23 Things They Don’t Tell You About Capitalism (London: Penguin, 2011). This conclusion holds, irrespective of confounding variables.

17 Raghuram Rajan, Fault Lines (Princeton: Princeton University Press, 2011).

18 Progressive income taxation is taken to be a tax scheme applied to a monetary (income) base, whereby the marginal tax rate rises in proportion with said base.

19 Martin Feldstein, ‘The Effect of Marginal Tax Rates on Taxable Income: a Panel Study of the 1986 Tax Reform Act’, The Journal of Political Economy, 103, no. 3 (1996), pp. 551-572.

20 Jon Gruber and Emmanuel Saez, ‘The elasticity of taxable income: evidence and implications’, Journal of Public Economics, 84, no. 1 (2002), pp. 1-32.

21 Nigel Morris, ‘Frank Field: Universal credit is so badly designed it traps families in poverty’, iNews, 15 September 2017.

22 Hugh Dalton, Principles of Public Finance (Oxford: Routledge, 1922).

23 John Hills, Good Times, Bad Times (Bristol: Bristol University Press, 2017).

Notably, ‘fiscal sustainability’ need not equate to ‘balancing the budget’, particularly today, with long-term interest rates the lowest in recorded history. Part of the confusion over deficits comes from treating welfare expenditure as consumption as opposed to investment which brings returns through the multiplier effect, productivity improvements and the avoidance of further costs to the state (healthcare or rent and council tax arrears, for example). The now-discredited Reinhardt and Rogoff study is another contributing factor.

24Tracy Shildrick, Robert MacDonald, Andy Furlong, Johann Roden and Robert Crow, Are Cultures of Worklessness Passed Down Through Generations? (London: Joseph Rowntree Foundation, 2012). In this major study, the Joseph Rowntree Foundation failed to identify a single family in the UK where worklessness had persisted for three or more generations and found that those who were long-term unemployed remained committed to the value of work.

25 Era Dabla-Norris, Kalpana Kochhar, Frantisek Ricka, Nujin Suphaphiphat, and Evridiki Tsounta, Causes and Consequences of Income Inequality: A Global Perspective (Washington: International Monetary Fund, 2015).

26 Edward Wolff, ‘Inheritances and Wealth Inequality, 1989-1998’, American Economic Review, 92, no. 2 (2002), pp. 260-264.

27 Joseph Stiglitz, ‘Notes on Estate Taxes, Redistribution and the Concept of Balanced Growth Path Incidence’, Journal of Political Economy, 86, no. 2 (1978), pp. 137-150.

28 Mikael Elinder, Oscar Erixson and Daniel Waldenstrom, Inheritance and Wealth Inequality: Evidence from Population Registers (London: Centre for Economic Policy Research, 2016).

29 The Editorial Board, ‘Why the UK’s inheritance tax needs to be reformed’, The Financial Times, 12 July 2019.

30 Tobin taxation can therefore be considered a progressive policy and falls within the category of ‘forced redistribution’. 31 Ben Patterson and Mickal Galliano, The Feasibility of an International “Tobin Tax” (Luxembourg: European Parliament, 1999).

32 Chris Rhodes, Financial services: contribution to the UK economy (London: House of Commons Library, 2019).

33 Pierre Chaigneau, The Tobin Tax, 10 July 2011

34 Ibid.

35 Allan Meltzer and Scott Richard, ‘A Rational Theory of the Size of Government’, Journal of Political Economy, 89, no.1 (1981), pp. 914-1927.

36 Valentino Larcinese, ‘Voting over Redistribution and the Size of the Welfare State: The Role of Turnout’, Political Studies, 55, no. 3 (2007), pp. 568-585.

37 Michael Norton, David Neal, Cassandra Govan, Dan Ariley and Elise Holland, ‘The Not-So-Common-Wealth of Australia: Evidence for a Cross-Cultural Desire for a More Equal Distribution of Wealth’, Analyses of Social Issues and Public Policy, 14, no. 1 (2014), pp. 339-351.

38 World Economic Forum, The Future of Jobs Report (Geneva: World Economic Forum, 2018).

39 Hans Moravec, Mind Children (Cambridge: Harvard University Press, 1988).

40 Pierre Bourdieu and Jean-Claude Passeron, ‘Cultural Reproduction and Social Reproduction’, in Jerome Karabel and Albert Halsey (eds), Power and Ideology in Education (New York: Oxford University Press, 1977), pp. 487-511. Suggestions range from Johnsonite infrastructure investment to Corbynite company restructuring.

41 In Capital vol. 1 Marx writes that alongside generating intolerable levels of ‘misery, oppression, slavery, degradation and oppression’, the concentration of wealth poses ‘a fetter upon the laws of production’. For the reasons outlined in the first section of this essay, we might consider this to be among his most prescient claims.

Bibliography

Acocella, Nicola, The Foundations of Economic Policy. Cambridge: Cambridge University Press, 2000.

Bourdieu, Pierre and Passeron, Jean-Claude, ‘Cultural Reproduction and Social Reproduction’, in Jerome Karabel and Albert Halsey (eds), Power and Ideology in Education. New York: Oxford University Press, 1977, pp. 487-511.

Chaigneau, Pierre, The Tobin Tax, 10 July 2011

Chang, Ha-Joon, 23 Things They Don’t Tell You About Capitalism. London: Penguin, 2011.

Dabla-Norris, Era, Kochhar, Kalpana, Ricka, Frantisek, Suphaphiphat, Nujin and Tsounta, Evridiki Causes and Consequences of Income Inequality: A Global Perspective. Washington: International Monetary Fund, 2015.

Dalton, Hugh, Principles of Public Finance. Oxford: Routledge, 1922.

Editorial Board, ‘Why the UK’s inheritance tax needs to be reformed’, The Financial Times, 12 July 2019.

Elinder, Mikael, Erixson, Oskar and Waldenstrom, Daniel, Inheritance and Wealth Inequality: Evidence from Population Registers. London: Centre for Economic Policy Research, 2016.

Elliott, Larry, ‘Unemployment due to Covid-19 is surely worth more than a footnote.’ The Guardian, 10 May 2020.

Feldstein, Martin, ‘The Effect of Marginal Tax Rates on Taxable Income: a Panel Study of the 1986 Tax Reform Act’, The Journal of Political Economy, 103, no. 3 (1996), pp. 551-572.

Foucault, Michel, The Birth of Biopolitics: Lectures at the College de France, 1978-1979. London: Palgrave Macmillan, 2008.

Hacker, Jacob, The Great Risk Shift. Oxford: Oxford University Press, 2008. Hana, Rema, Dispelling the Myth of Welfare Dependency, 9 August 2019

Hills, John, Good Times, Bad Times. Bristol: Bristol University Press, 2017.

Kaldor, Nicholas, ‘Alternative Theories of Distribution’, The Review of Economic Studies, 23, no. 2 (1956), pp. 83-100.

Larcinese, Valentino, ‘Voting over Redistribution and the Size of the Welfare State: The Role of Turnout’, Political Studies, 55, no. 3 (2007), pp. 568-585.

Leaders, ‘Big tech is thriving in the midst of the recession’, The Economist, 2 May 2020.

Leigh, Andrew, Jencks, Christopher and Smeeding, Timothy, ‘Health and Economic Inequality’, in Wiemer Salverda, Brian Nolan and Timothy Smeeding (eds), The Oxford Handbook of Economic Inequality. Oxford: Oxford University Press, 2009.

Norton, Michael, Neal, David, Govan, Cassandra, Ariley Dan, and Holland, Elise, ‘The Not-So-Common-Wealth of Australia: Evidence for a Cross-Cultural Desire for a More Equal Distribution of Wealth’, Analyses of Social Issues and Public Policy, 14, no. 1 (2014), pp. 339-351.

Marx, Karl, Capital: a Critique of Political Economy v.1. London: Penguin Classics, 1990.

Meltzer, Allan and Richard, Scott, ‘A Rational Theory of the Size of Government’, Journal of Political Economy, 89, no.1 (1981), pp. 914-1927.

Moravec, Hans, Mind Children. Cambridge: Harvard University Press, 1988.

Morris, Nigel, ‘Frank Field: Universal credit is so badly designed it traps families in poverty’, iNews, 15 September 2017.

Patterson, Ben and Galliano, Mickal, The Feasibility of an International “Tobin Tax.” Luxembourg: European Parliament, 1999.

Piketty, Thomas, Capital in the Twenty First Century. Cambridge: Harvard University Press, 2014. Rajan, Raghuram, Fault Lines. Princeton: Princeton University Press, 2011.

Rhodes, Chris, Financial services: contribution to the UK economy. London: House of Commons Library, 2019.

Rowlingson, Karen, Does Income Inequality Cause Health and Social Problems? York: Joseph Rowntree Foundation, 2011.

Roy, Indranil, Future of Work: an Introduction, January 2019

Shildrick, Tracy, MacDonald, Robert, Furlong, Andy, Roden, Johann and Crow, Robert, Are Cultures of Worklessness Passed Down Through Generations? London: Joseph Rowntree Foundation, 2012.

Srnicek, Nick, Platform Capitalism. Cambridge: Polity Press, 2016.

Stiglitz, Joseph, ‘Notes on Estate Taxes, Redistribution and the Concept of Balanced Growth Path Incidence’, Journal of Political Economy, 86, no. 2 (1978), pp. 137-150. Stiglitz, Joseph, The Price of Inequality. London: Penguin, 2013.

Vandermoortele, Jan, ‘Inequality and Gresham’s Law: the bad drives out the good’, Unpublished thinkpiece for the UN in China, March 2013.

Wilkinson, Richard and Pickett, Kate, The Inner Level. London: Penguin Books, 2018.

Wilkinson, Richard and Pickett, Kate, The Spirit Level: Why Equality is Better for Everyone. London: Penguin Books, 2009.

Wolff, Edward, ‘Inheritances and Wealth Inequality, 1989-1998’, American Economic Review, 92, no. 2 (2002), pp. 260-264.

World Economic Forum, The Future of Jobs Report. Geneva: World Economic Forum, 2018.